Navigating Regions Bank’s Geographic Reach: A Comprehensive Overview

Related Articles: Navigating Regions Bank’s Geographic Reach: A Comprehensive Overview

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Regions Bank’s Geographic Reach: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Regions Bank’s Geographic Reach: A Comprehensive Overview

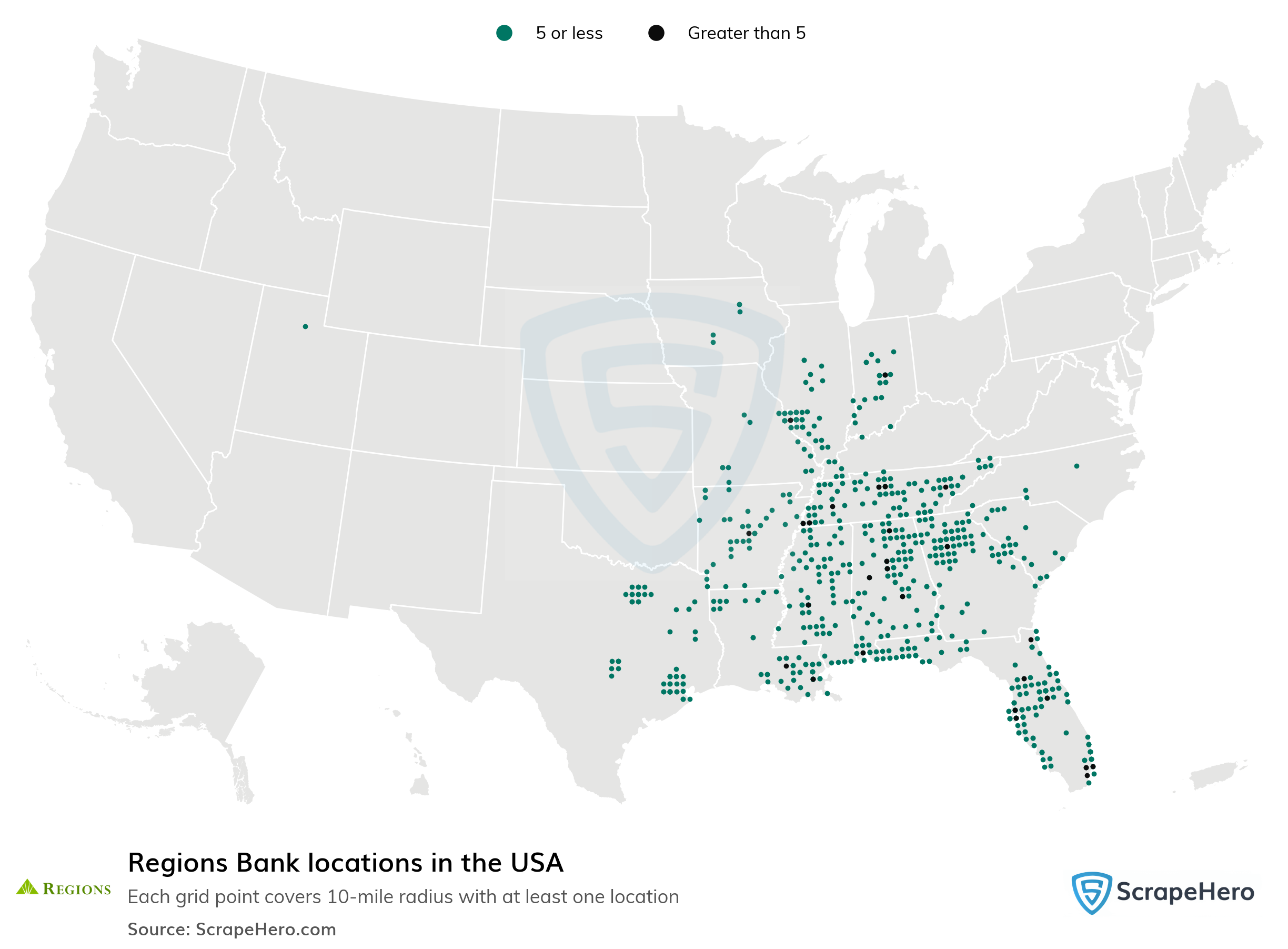

Regions Bank, a significant player in the southeastern United States banking landscape, maintains a substantial network of branches and ATMs. Understanding the spatial distribution of these financial services points is crucial for both existing and prospective customers, businesses seeking banking partners, and researchers analyzing the bank’s market penetration. This analysis explores the geographical reach of Regions Bank, highlighting the significance of its location strategy and the tools available to access this information.

Visualizing the Network:

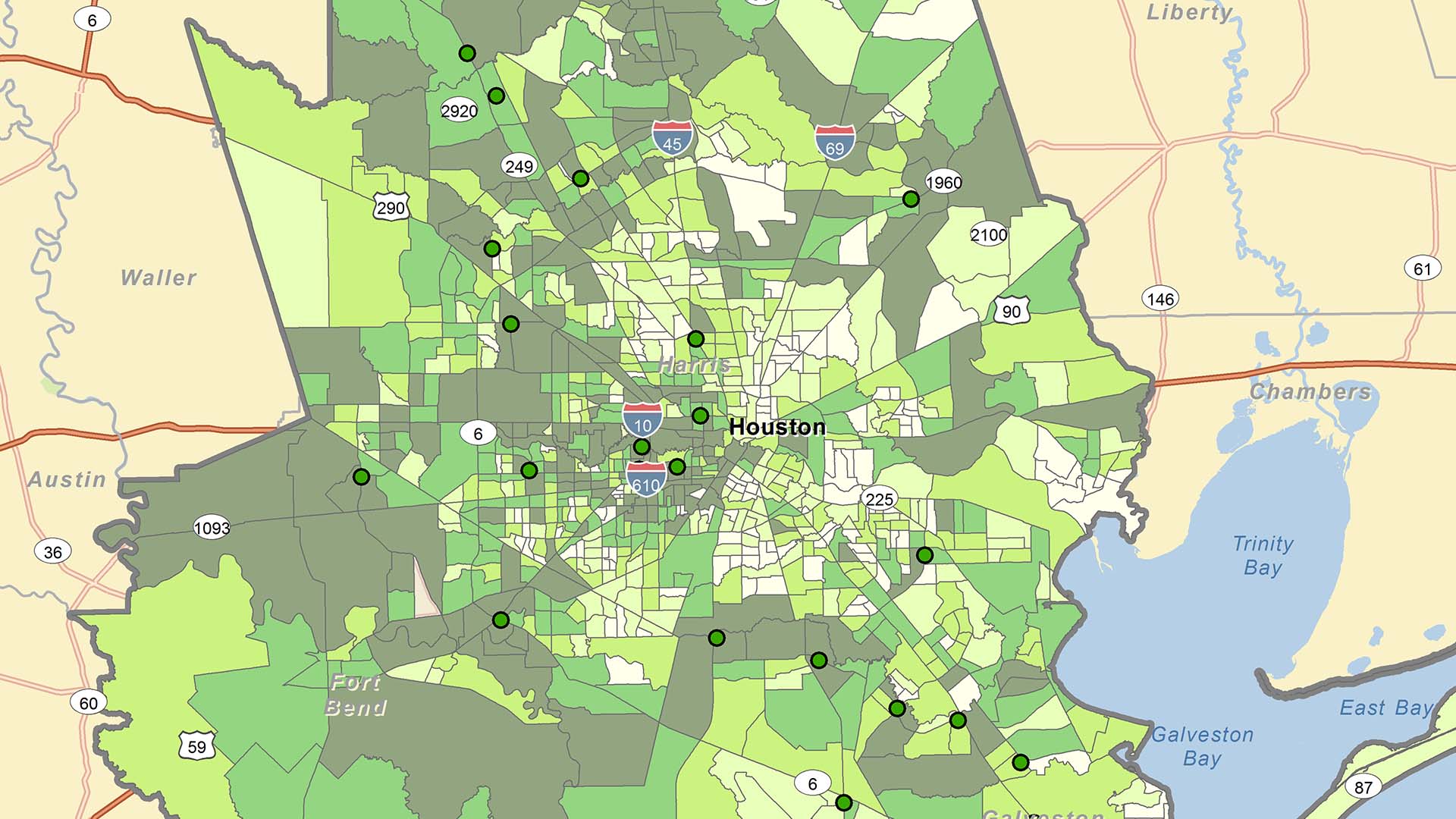

The most effective way to comprehend Regions Bank’s physical presence is through a visual representation. Interactive online maps, available on the Regions Bank website and through third-party mapping services, provide detailed visualizations of branch locations. These maps typically allow users to zoom in and out, search by address or city, and filter results based on specific service offerings like ATMs or mortgage lending centers. The visual nature of these maps allows for a quick assessment of branch density in various regions, revealing areas of high concentration and those with limited access. Color-coding or other visual cues often differentiate branch types, highlighting the range of services offered at each location.

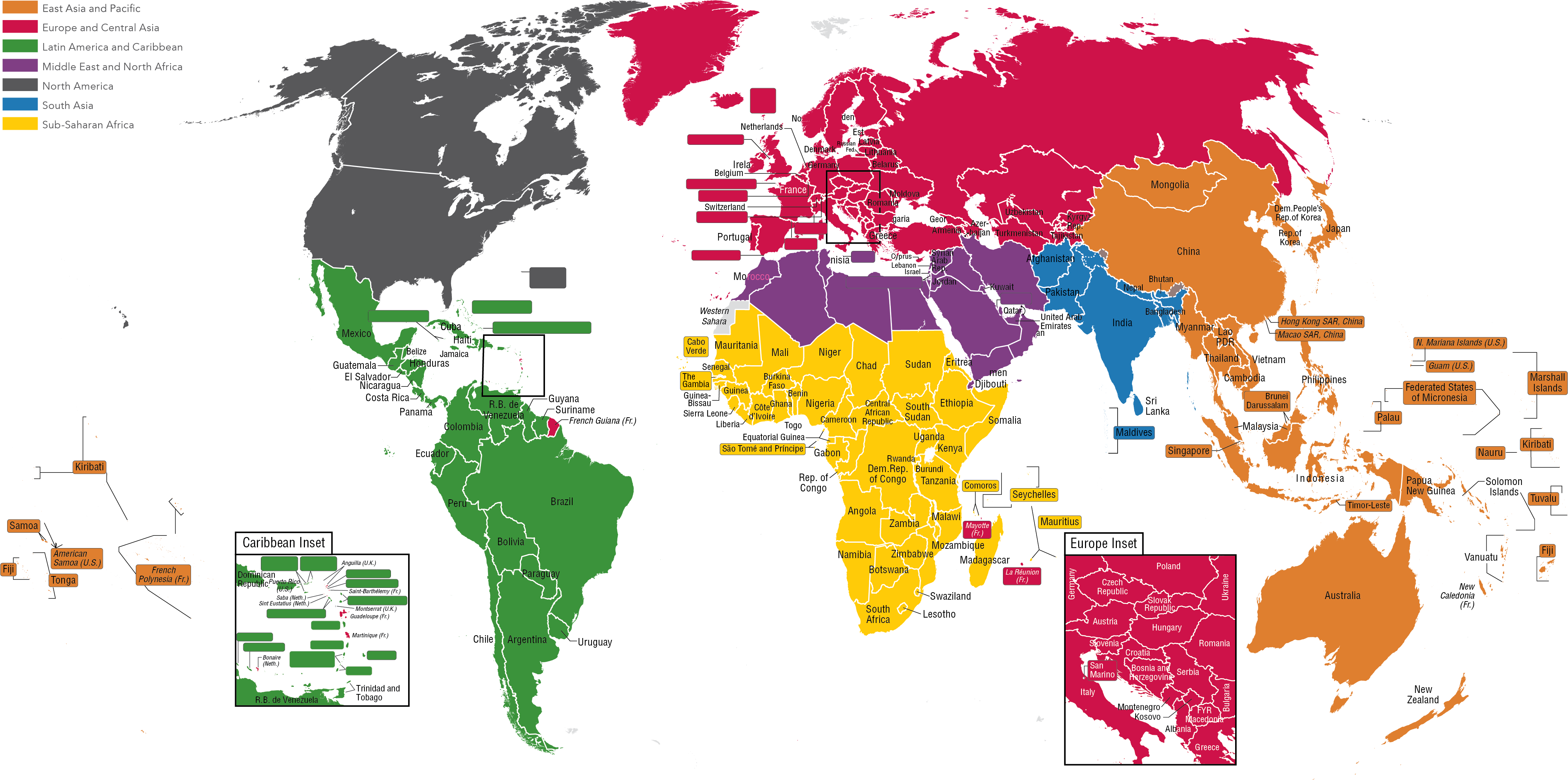

Geographic Distribution and Market Strategy:

Regions Bank’s branch network reflects a deliberate market strategy focused primarily on the southeastern United States. The concentration of branches is noticeably higher in states like Alabama, Florida, Georgia, Tennessee, and Texas, reflecting significant market share and customer bases in these regions. The map reveals a pattern of denser networks in major metropolitan areas, reflecting the concentration of population and business activity. Conversely, less populated areas may have fewer branches, often relying on ATMs or digital banking services to provide access to financial services. Analyzing the distribution patterns on the map provides insight into Regions Bank’s strategic decisions regarding market penetration and resource allocation.

Beyond Branch Locations: ATM Accessibility and Digital Presence

While the map primarily showcases branch locations, it often integrates data on ATM accessibility. This is a crucial aspect of convenience for customers, especially those who may not live near a full-service branch. The inclusion of ATM locations on the map provides a more holistic picture of Regions Bank’s overall accessibility. Furthermore, while not directly visible on the map itself, the bank’s robust online and mobile banking platforms extend its reach far beyond its physical locations, offering services to customers regardless of geographic proximity to a branch or ATM.

The Importance of Geographic Data in Financial Decision-Making:

Access to accurate and up-to-date information on Regions Bank’s branch and ATM locations holds significant value for several stakeholders. For potential customers, the map facilitates the identification of nearby locations, allowing for convenient access to banking services. Businesses considering Regions Bank as a financial partner can use the map to assess the bank’s presence within their target market, evaluating the potential for convenient collaboration and support. Researchers and analysts can leverage this data to study market trends, competitive landscapes, and the impact of geographic factors on banking penetration.

Frequently Asked Questions:

-

Q: How accurate is the online map of Regions Bank locations? A: Regions Bank strives to maintain accurate and up-to-date information on its website. However, occasional discrepancies may occur due to ongoing changes in the branch network. It is recommended to verify information directly with the bank before relying on it for critical decisions.

-

Q: What types of services are offered at each branch location? A: Detailed information on the specific services offered at each branch is usually available on the bank’s website by selecting the individual branch location on the map. This information may vary depending on the size and location of the branch.

-

Q: Are there any limitations to the information provided on the map? A: The map primarily focuses on branch and ATM locations. It may not include information on mobile banking services or other non-physical access points.

-

Q: How can I report an inaccuracy on the map? A: Contact information for reporting inaccuracies is typically available on the bank’s website, often linked to the map itself.

Tips for Utilizing the Map Effectively:

- Use the search function: Enter your address or city to quickly locate nearby branches and ATMs.

- Zoom in and out: Adjust the map’s zoom level to examine the branch density in different areas.

- Utilize filters: If available, use filters to refine your search based on specific services.

- Verify information: Confirm the branch’s hours of operation and services offered directly through the bank’s website or by contacting the branch.

- Consider alternative access points: Remember that online and mobile banking provide convenient alternatives to in-person banking.

Conclusion:

The geographic distribution of Regions Bank’s branches and ATMs, readily visualized through online mapping tools, provides valuable insights into the bank’s market strategy, accessibility, and overall reach. Understanding this spatial distribution is essential for customers, businesses, and researchers alike. By effectively utilizing the available map resources and verifying information, individuals and organizations can make informed decisions regarding their interactions with Regions Bank and its extensive network of financial services. The ongoing evolution of the bank’s physical and digital presence necessitates continuous monitoring of this information to maintain a current understanding of its accessibility.

Closure

Thus, we hope this article has provided valuable insights into Navigating Regions Bank’s Geographic Reach: A Comprehensive Overview. We thank you for taking the time to read this article. See you in our next article!