Navigating Rural Homeownership in Florida: A Comprehensive Guide to Eligibility and Resources

Related Articles: Navigating Rural Homeownership in Florida: A Comprehensive Guide to Eligibility and Resources

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Rural Homeownership in Florida: A Comprehensive Guide to Eligibility and Resources. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Homeownership in Florida: A Comprehensive Guide to Eligibility and Resources

Florida, a state known for its diverse landscapes and vibrant communities, offers unique opportunities for homebuyers seeking affordable financing options. A significant portion of the state qualifies for specific rural development programs designed to expand access to homeownership in less populated areas. Understanding the geographic scope of these programs and their associated benefits is crucial for prospective homebuyers.

This guide provides a detailed examination of the eligibility criteria and resources available to individuals seeking to purchase homes in designated rural areas of Florida. It clarifies the process of determining eligibility, highlights the benefits of utilizing these programs, and offers practical advice for navigating the application process successfully.

Understanding the Geographic Scope

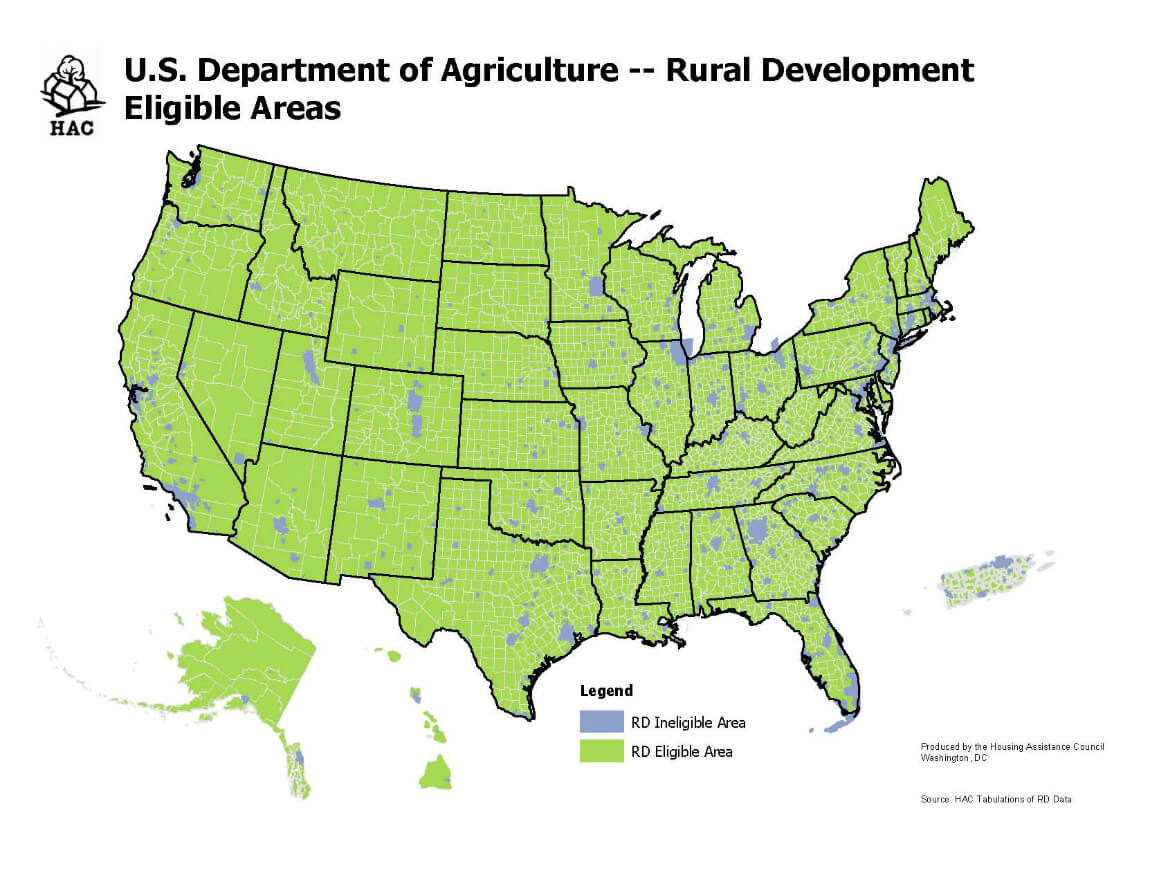

Determining eligibility for these programs hinges on location. The designated rural areas are not uniformly distributed across Florida. Some counties may have significant portions qualifying, while others may have only limited areas or none at all. The boundaries are not always intuitive and are subject to change. Therefore, it is essential to consult the official USDA eligibility map. This map, regularly updated, displays precise boundaries defining areas where these programs are available. Prospective homebuyers should use the online mapping tool to verify their property’s location before initiating the application process. The map’s functionality allows users to input addresses or search by county, providing a clear indication of eligibility.

The map’s importance cannot be overstated. It prevents wasted time and effort by allowing applicants to determine their eligibility early in the process. This early verification saves applicants from pursuing a loan application that may ultimately be denied due to location. Utilizing the map is the first critical step in navigating the application process.

Benefits of Utilizing Rural Development Programs

These programs offer several advantages to eligible homebuyers. A key benefit is the potential for lower interest rates and more favorable financing terms compared to conventional mortgages. This affordability is a critical factor for many prospective homebuyers, particularly those with limited financial resources. Furthermore, these programs often require lower down payments than traditional loans, making homeownership accessible to a wider range of individuals. Some programs even offer loan guarantees, mitigating risk for lenders and making it easier for borrowers to qualify.

Beyond the financial benefits, these programs contribute to the growth and stability of rural communities. By making homeownership more accessible, these initiatives help attract new residents and support local economies. This, in turn, contributes to the overall vitality and sustainability of rural areas in Florida.

Navigating the Application Process

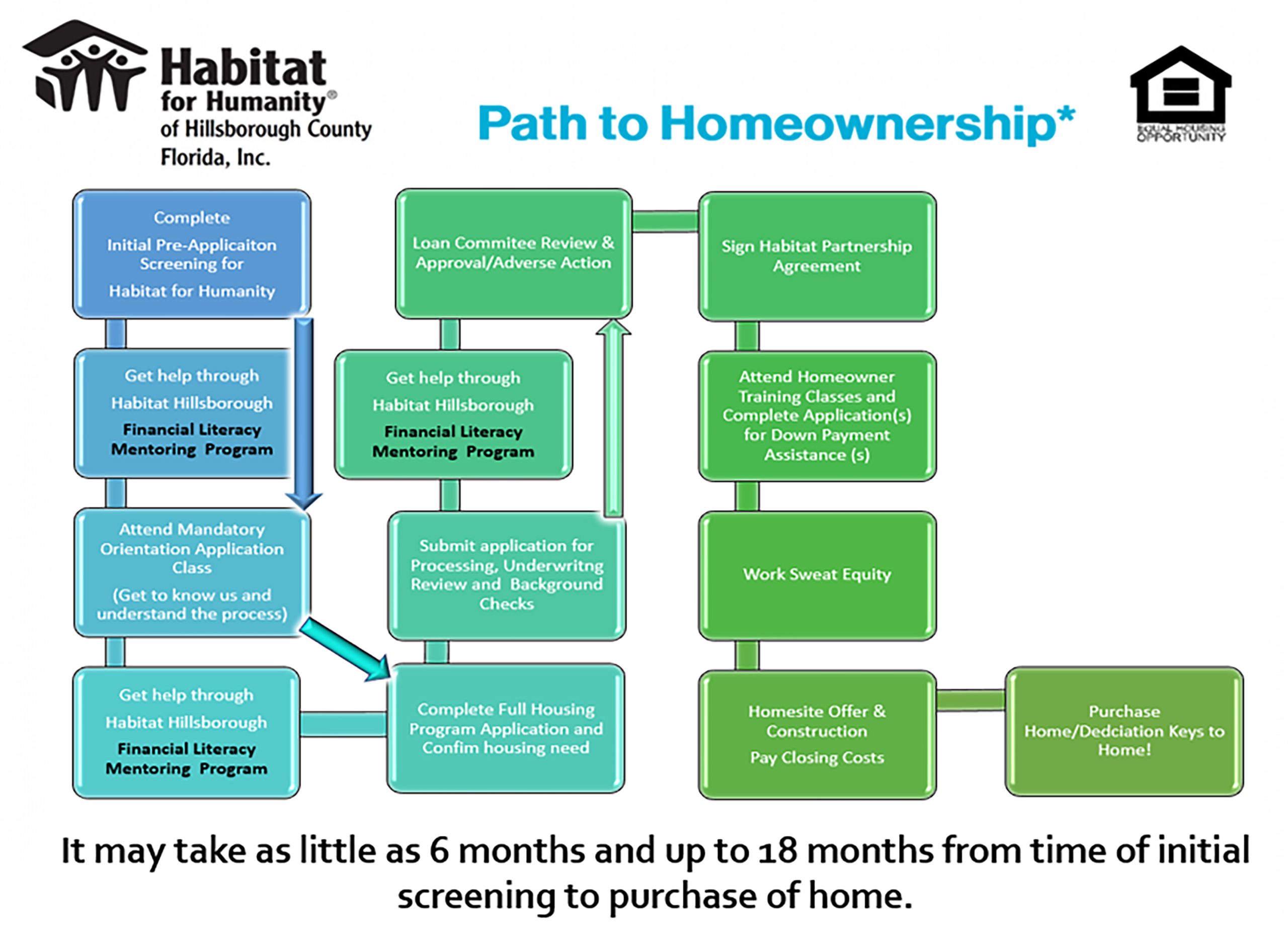

The application process involves several steps, requiring careful attention to detail. First, it’s crucial to verify eligibility using the official map. Once eligibility is confirmed, applicants will need to gather the necessary documentation, including proof of income, credit reports, and employment history. Thorough preparation is essential for a smooth and efficient application process.

Applicants should also be prepared to provide detailed information about the property they intend to purchase. This includes appraisal reports and other relevant documentation. It is advisable to work closely with a qualified lender experienced in handling these types of loans. Their expertise can be invaluable in navigating the complexities of the application process and ensuring a successful outcome.

Frequently Asked Questions

-

Q: What constitutes a "rural" area in Florida for the purposes of these loans? A: The definition of "rural" is determined by the USDA and is based on population density and other factors. The official map provides the most precise delineation of eligible areas.

-

Q: What types of properties are eligible for financing? A: Generally, properties intended for primary residences are eligible. However, specific requirements may vary depending on the program and the property’s characteristics.

-

Q: What is the maximum loan amount? A: The maximum loan amount varies depending on the program and the location of the property. Detailed information is available through the USDA’s website and participating lenders.

-

Q: What are the credit score requirements? A: Credit score requirements vary. While a high credit score is beneficial, some programs may offer more flexibility for borrowers with less-than-perfect credit histories.

-

Q: What documents are required for the application? A: The required documentation typically includes proof of income, credit reports, employment history, property appraisal, and other relevant financial information. Specific requirements should be obtained from the lender or USDA website.

Tips for a Successful Application

- Thorough research: Fully understand the program requirements and eligibility criteria before applying.

- Early preparation: Gather all necessary documentation well in advance of the application deadline.

- Work with a qualified lender: Seek assistance from a lender experienced in processing these types of loans.

- Maintain accurate financial records: Provide accurate and complete financial information to streamline the application process.

- Monitor application status: Stay informed about the progress of the application and address any queries promptly.

Conclusion

Accessing homeownership in Florida’s rural areas presents unique opportunities for individuals seeking affordable financing options. By utilizing the resources available through these rural development programs and carefully navigating the application process, prospective homebuyers can achieve their dream of homeownership. Understanding the geographic scope of eligibility, the benefits of these programs, and the practical steps involved in applying is critical for success. The official USDA eligibility map serves as an indispensable tool in this process, enabling prospective homebuyers to determine eligibility and plan accordingly. Prospective homebuyers are encouraged to conduct thorough research and seek assistance from qualified professionals to maximize their chances of securing these valuable financing options.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Homeownership in Florida: A Comprehensive Guide to Eligibility and Resources. We thank you for taking the time to read this article. See you in our next article!