Navigating Rural Homeownership in Florida: Understanding USDA Loan Eligibility

Related Articles: Navigating Rural Homeownership in Florida: Understanding USDA Loan Eligibility

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Rural Homeownership in Florida: Understanding USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Homeownership in Florida: Understanding USDA Loan Eligibility

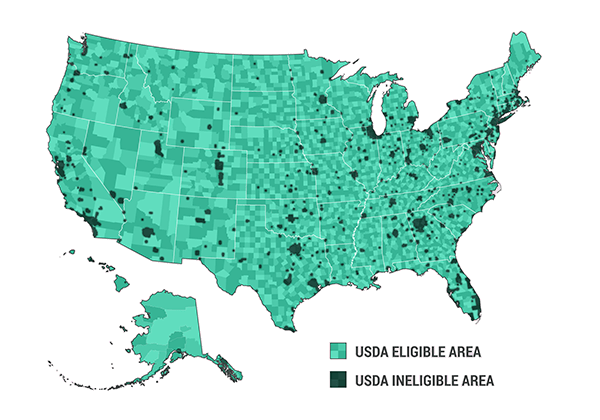

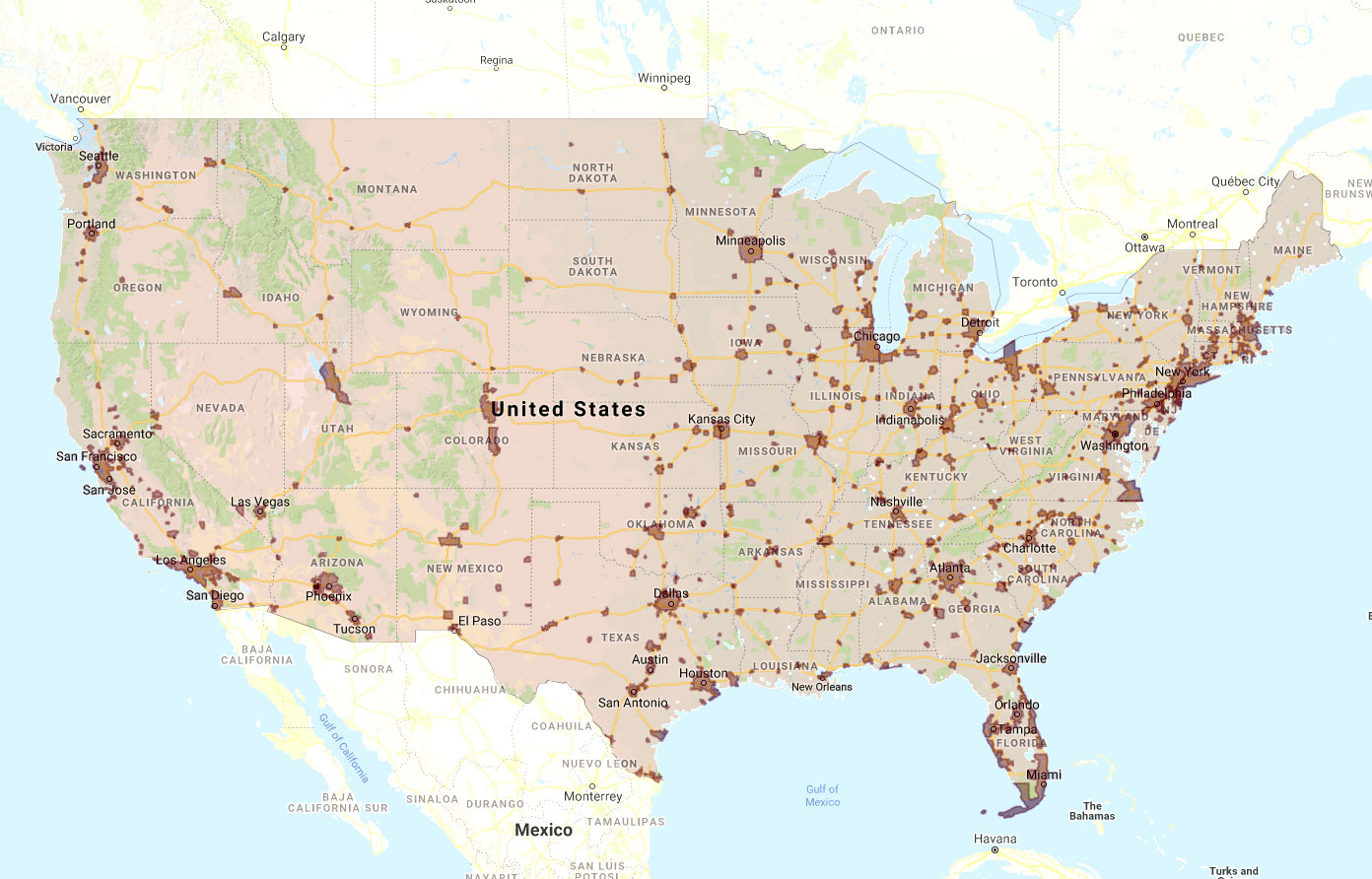

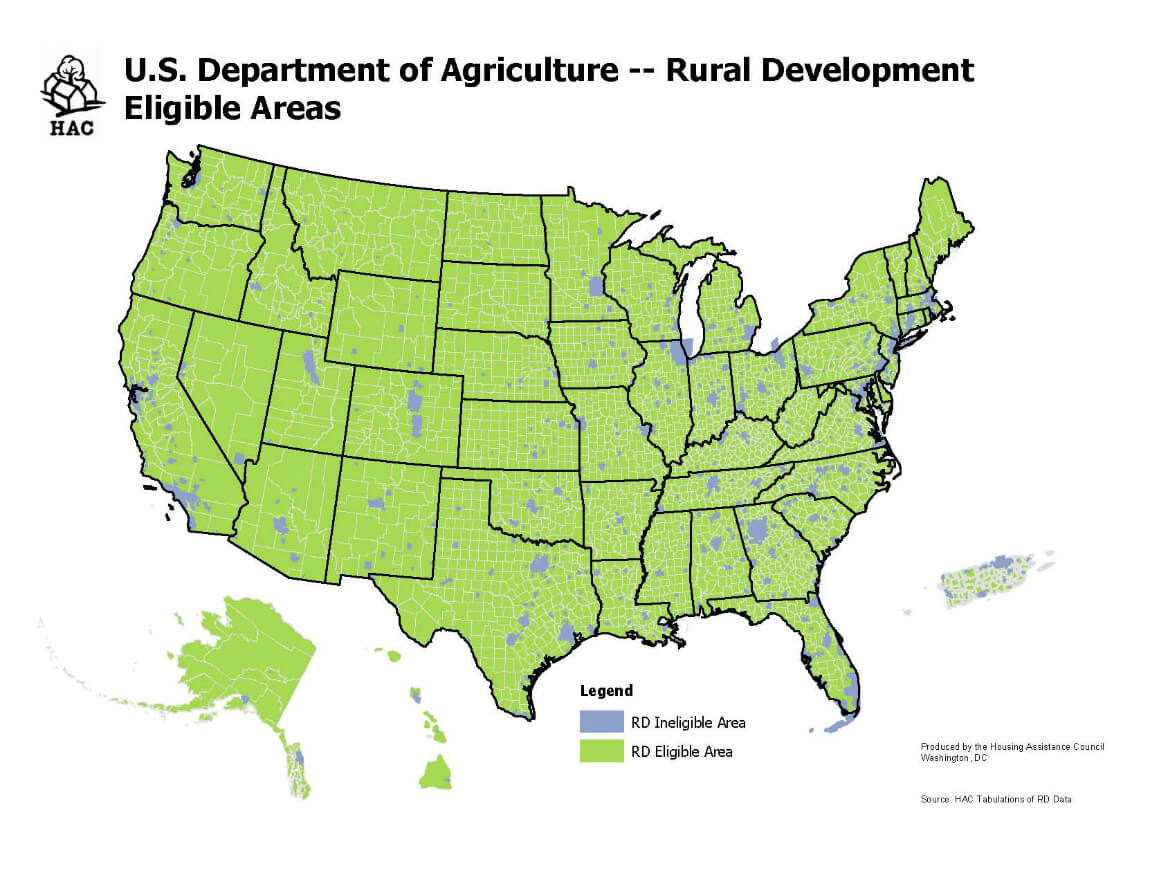

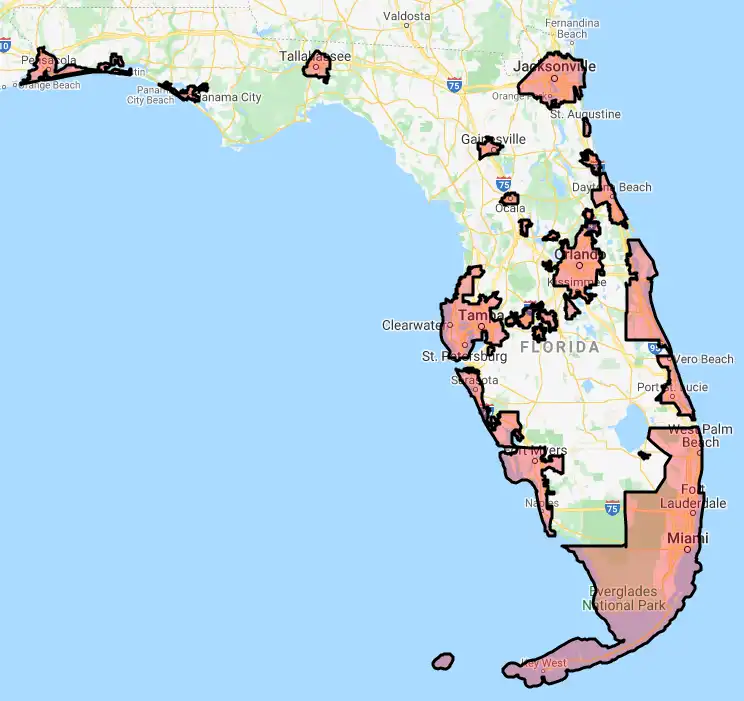

Florida, a state known for its diverse landscapes and vibrant communities, offers a range of housing options. For those seeking affordable homeownership in less densely populated areas, the United States Department of Agriculture (USDA) Rural Development Guaranteed Housing Loan program presents a significant opportunity. Understanding the geographic scope of this program within the state is crucial for prospective homebuyers. While a visual representation, often referred to as a map, doesn’t directly define eligibility, it serves as a valuable tool for preliminary assessment.

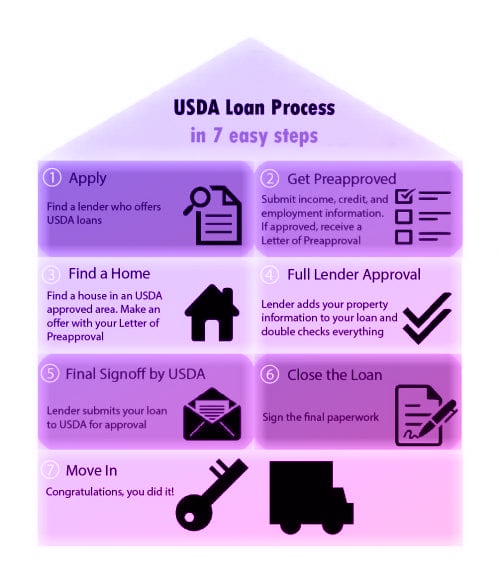

The program’s eligibility hinges on location, not solely on the presence of rural characteristics. Areas designated as eligible are determined through a complex process considering population density, infrastructure, and proximity to essential services. This designation is constantly reviewed and updated, reflecting changes in population and development. Therefore, relying solely on older maps can lead to inaccurate conclusions. The most current and accurate information regarding eligibility is always found on the USDA Rural Development website.

The visual representation of eligible areas can help prospective borrowers quickly determine whether their desired location falls within the program’s reach. It allows for a preliminary screening, eliminating the need for extensive initial research into specific addresses. However, it is essential to understand that the map is a guide, not a definitive statement of eligibility. A property’s precise location must be verified through the USDA’s official online tools and databases before proceeding with a loan application.

Understanding the Nuances of Eligibility beyond the Visual Guide

Beyond the visual representation of eligible areas, several other factors contribute to loan approval. These include:

- Credit Score: A strong credit history is a prerequisite for most loan programs, and the USDA program is no exception. A higher credit score generally improves the chances of approval and may lead to more favorable loan terms.

- Income Limits: Income limitations are applied to ensure the program targets those who need the assistance most. These limits vary depending on location and household size. Exceeding these limits would render a borrower ineligible, regardless of location.

- Property Type: The program typically supports the purchase of single-family homes for primary residences. Certain restrictions may apply to multi-family dwellings or other property types.

- Property Condition: The property must meet specific habitability standards to qualify for the loan. Inspections are typically conducted to ensure the home is safe and structurally sound.

- Loan Amount: The maximum loan amount varies based on location and property value. It’s crucial to understand the limits for the specific area before making an offer on a property.

Frequently Asked Questions

-

Q: Is there a physical map I can obtain to check eligibility?

- A: While some unofficial representations exist, the most accurate and up-to-date information is available exclusively through the USDA Rural Development website’s eligibility tool. Using unofficial sources may lead to inaccurate conclusions.

-

Q: How often are the eligible areas updated?

- A: The eligible areas are regularly reviewed and updated. It is crucial to check the USDA’s website for the most current information before beginning the loan application process.

-

Q: What happens if my property is on the border of an eligible area?

- A: Properties located on the border of eligible areas require a precise address verification through the USDA’s online tools. The final determination rests solely with the USDA.

-

Q: Can I use this loan to purchase land only?

- A: The program primarily supports the purchase of existing homes or the construction of new homes. Land purchases alone are generally not eligible.

Tips for Prospective Borrowers

- Utilize the USDA’s online tools: Begin by using the official USDA Rural Development website to verify the eligibility of your desired location.

- Seek professional guidance: Consult with a mortgage lender experienced with USDA loans to understand the application process and eligibility requirements.

- Prepare your financial documentation: Gather all necessary financial documents well in advance to expedite the application process.

- Understand the closing costs: While the loan offers attractive interest rates, be prepared for closing costs, which can vary.

- Maintain a strong credit score: A higher credit score significantly improves the chances of loan approval and can lead to better terms.

Conclusion

The USDA Rural Development Guaranteed Housing Loan program offers a valuable pathway to homeownership in eligible rural areas of Florida. While a visual representation of eligible areas provides a preliminary assessment, it is crucial to use official USDA resources to verify eligibility. Understanding the program’s requirements, beyond the geographic limitations, is essential for a successful application. Thorough preparation, including financial documentation and professional guidance, significantly increases the chances of securing a USDA loan and achieving the dream of homeownership in Florida’s diverse countryside.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Homeownership in Florida: Understanding USDA Loan Eligibility. We thank you for taking the time to read this article. See you in our next article!